401k rollover to roth ira tax calculator

401 k IRA Rollover Calculator. Roth 401ks as an Alternative.

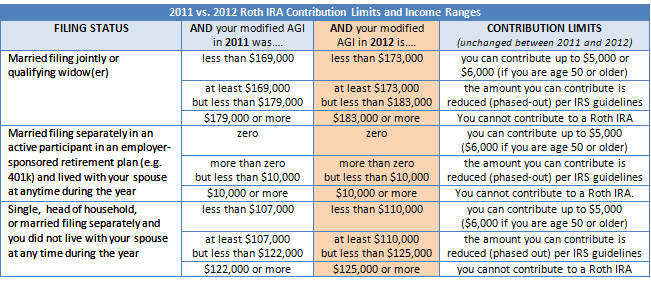

2022 Vs 2021 Roth Ira Contribution And Income Limits Plus Conversion Rollover Rules Aving To Invest

Heres how it works.

. Do Your Investments Align with Your Goals. If your employer offers. Withdrawals from a Roth IRA or.

Your IRA could decrease 2138 with a Roth. Pros of Roth IRA. If youre looking to do a rollover from a Roth 401 to a Roth IRA the process is quite simple.

If you have a 500000 portfolio download your free copy of this guide now. Lets look at a hypothetical example of a 401 k rollover to a Roth IRA. It increases your income and you pay your.

When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year. For some investors this could prove. This means that there are tax consequences if you rollover a 401 k to Roth IRA.

In fact its an. Roth IRAs are the only tax-sheltered retirement plans that do not impose RMDs. This calculator will compare the consequences of taking a lump-sum distribution of your 401 k or IRA versus continuing to save it in or roll it into a tax.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Use this Roth IRA rollover calculator to project the inflation-adjusted value of your Traditional IRA or 401k at retirement versus the inflation-adjusted value of the same funds at retirement if. A Roth 401k combines the employer-sponsored nature of the traditional 401k with the tax structure of the Roth IRA.

Find a Dedicated Financial Advisor Now. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. You will likely have to pay income tax on the previously untaxed portion of the distribution that you rollover to a designated Roth account or a Roth IRA.

Protect Yourself From Inflation. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional.

10 Best Companies to Rollover Your 401K into a Gold IRA. Schwab Has 247 Professional Guidance. Roth Conversion Calculator Methodology General Context.

Schwab Can Help You Make A Smooth Job Transition. Ad Learn How Fidelity Can Help You Roll Over Your Old 401k Plan. Because a standard 401 k is funded with before-tax dollars you will need to pay taxes on.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. All youll have to do is follow the same steps as if you were rolling over a traditional 401. Ad Learn more about IRAs and the possible tax benefits of rolling over your 401k.

The easy answer to your second question is again yes you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401 k. Use our Roth IRA Conversion Calculator to compare estimated future values and taxes. How to Rollover a 401K.

Simplify Your 401k Rollover Decision. Do Your Investments Align with Your Goals. Ad It Is Easy To Get Started.

Lets assume Andrew is age 60 retired and has 1 million in his 401 k. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Find a Dedicated Financial Advisor Now. Rollover IRA401K Rollover Options.

The Ultimate Roth 401 K Guide District Capital Management

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Systematic Partial Roth Conversions Recharacterizations

Roth Ira Conversion Ameriprise Financial

Traditional Vs Roth Ira Calculator

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

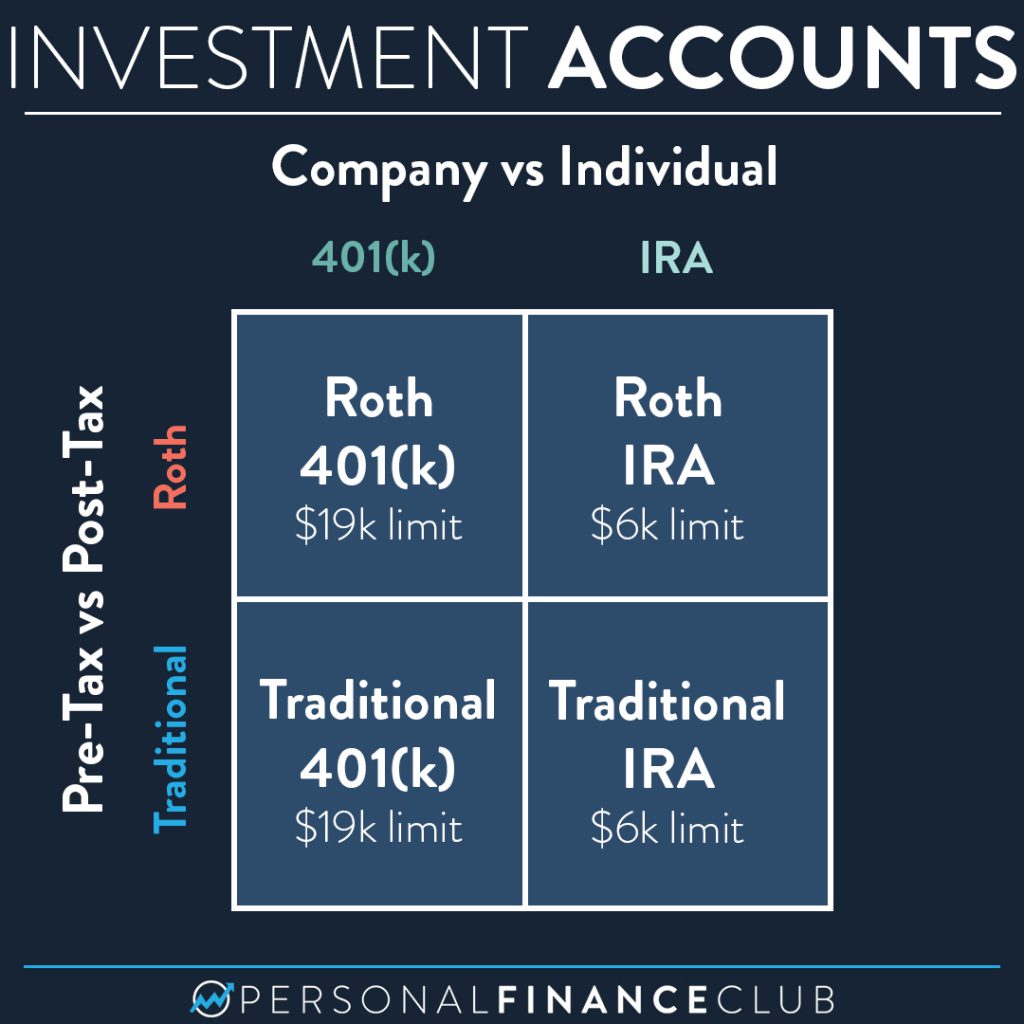

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Solo 401k My Solo 401k Financial

Roth 401k Roth Vs Traditional 401k Fidelity

How To Roll Over Your 401 K To A Roth Ira Smartasset

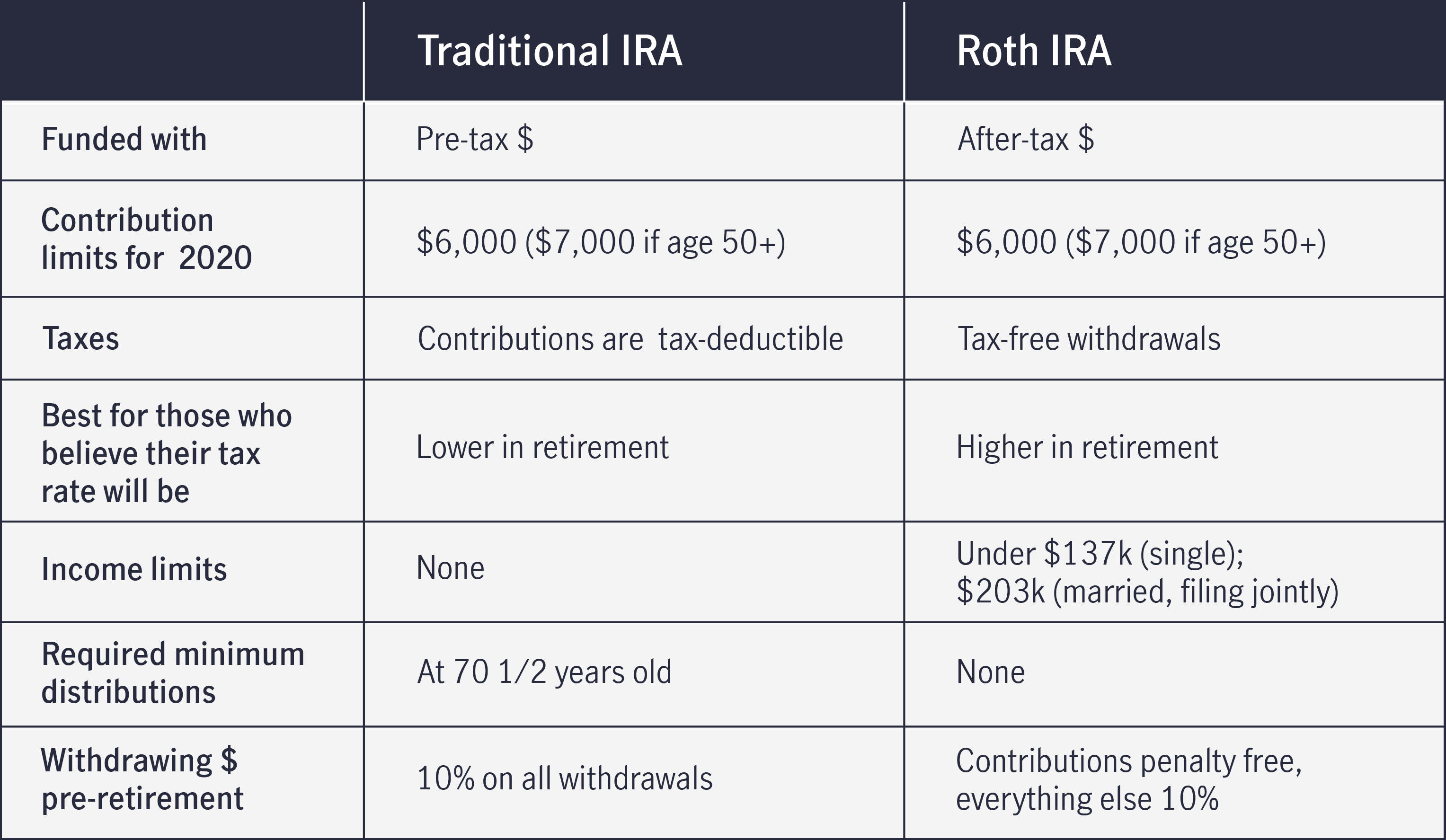

Comparing Traditional Iras Vs Roth Iras John Hancock

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

After Tax 401 K Contributions Retirement Benefits Fidelity

Traditional Vs Roth Ira Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal